Introduction

Ensuring your pet's health and well-being is a top priority for any pet owner. Pet insurance provides financial protection against unexpected veterinary bills, offering peace of mind. With numerous providers in the UK market, choosing the right policy can be challenging. This guide simplifies the process by comparing the top 10 pet insurance companies in the UK for 2025, detailing their plans, pricing, coverage, and key advantages and disadvantages. Bellow you will find the best pet insurance plans. If you are looking for the cheapest pet insurance in the UK, find them in our other post.

🏆 1. Petplan

Overview: Established in 1976, Petplan is one of the UK's leading pet insurance providers, known for its comprehensive coverage and high claim approval rates.

Link: https://www.petplan.co.uk/

Plans & Pricing:

-

Essential Plan: £3,000 per condition for 12 months.

-

Covered For Life® Plan: £4,000, £7,000, or £12,000 annually, refreshing each year upon renewal.

Coverage Highlights:

-

Chronic and hereditary conditions

-

Dental treatment (non-routine)

-

Complementary therapies

-

Behavioral conditions

Pros:

-

✅ High claim approval rate

-

✅ No penalty for making claims

-

✅ Option to pay vets directly

Cons:

-

❌ Premiums can be higher than competitors

-

❌ Limited coverage for pre-existing conditions

🥈 2. Agria Pet Insurance

Overview: Agria offers lifetime policies with substantial vet fee limits and has been recognized as a Which? Best Buy for 2025.

Link: https://www.agriapet.co.uk/

Plans & Pricing:

-

Lifetime Plan: Up to £20,000 vet fees annually.

-

Average Monthly Premium: £55.03

Coverage Highlights:

-

24/7 vet video consultations

-

Behavioral therapy

-

Dental illness and injury

-

Third-party liability

Pros:

-

✅ High annual vet fee limit

-

✅ No premium increase after claims

-

✅ Multi-pet discount available

Cons:

-

❌ Limited coverage for exotic pets

-

❌ Some treatments require pre-authorization

🥉 3. ManyPets (formerly Bought By Many)

Overview: ManyPets offers flexible policies, including coverage for pre-existing conditions, and provides perks for claim-free years.

Link: https://manypets.com/uk/

Plans & Pricing:

-

Complete Plan: Up to £15,000 vet fees annually.

-

Pre-existing Plan: Up to £7,000 vet fees annually.

-

Average Annual Premium: £590.40

Coverage Highlights:

-

Dental treatment (accident and illness)

-

Complementary therapies

-

Lost or stolen pet cover

-

24/7 video vet consultations

Pros:

-

✅ Covers recent pre-existing conditions

-

✅ 20% premium refund for no claims

-

✅ Multi-pet discounts

Cons:

-

❌ Co-payment required for pets over a certain age

-

❌ Limited coverage for routine care

4. Waggel

Overview: Waggel offers a single, customizable lifetime policy with a focus on simplicity and digital management.

Link: https://www.waggel.co.uk/

Plans & Pricing:

-

Lifetime Plan: Up to £10,000 vet fees annually.

-

Monthly Premiums: Range from £8 to over £150, depending on various factors.

Coverage Highlights:

-

Dental treatment

-

Behavioral therapy

-

Third-party liability

-

Online claims management

Pros:

-

✅ User-friendly digital platform

-

✅ Transparent pricing

-

✅ No upper age limit for enrollment

Cons:

-

❌ No coverage for pre-existing conditions

-

❌ Limited add-on options

5. Animal Friends

Overview: Animal Friends is known for its charitable contributions and offers a range of policies to suit different budgets.

Link: https://www.animalfriends.co.uk/

Plans & Pricing:

-

Basic Plan: Covers up to £1,000 per condition.

-

Lifetime Plan: Up to £18,000 vet fees annually.

Coverage Highlights:

-

Complementary treatments

-

Advertising and reward for lost pets

-

Overseas travel cover

Pros:

-

✅ Affordable premiums

-

✅ Supports animal welfare charities

-

✅ Wide range of policy options

Cons:

-

❌ Lower annual vet fee limits

-

❌ Some policies have time-limited coverage

6. Tesco Bank Pet Insurance

Overview: Backed by a reputable brand, Tesco Bank offers straightforward policies with Clubcard discounts.

Link: https://www.tescobank.com/pet-insurance/

Plans & Pricing:

-

Standard Plan: Covers up to £3,000 per condition.

-

Premier Plan: Up to £10,000 vet fees annually.

Coverage Highlights:

-

Dental treatment (accident only)

-

Third-party liability

-

Death from illness or injury

Pros:

-

✅ Clubcard members receive discounts

-

✅ 24/7 vet helpline

-

✅ Multi-pet discount

Cons:

-

❌ Limited dental coverage

-

❌ No coverage for pre-existing conditions

7. Direct Line Pet Insurance

Overview: Direct Line offers comprehensive policies with optional add-ons for enhanced coverage.

Link: https://www.directline.com/pet-cover

Plans & Pricing:

-

Essential Plan: Covers up to £4,000 per condition.

-

Advanced Plan: Up to £8,000 vet fees annually.

-

Monthly Premiums: Starting from £10.27.

Coverage Highlights:

-

Behavioral treatment

-

Overseas travel cover

-

Advertising and reward for lost pets

Pros:

-

✅ Optional add-ons for customization

-

✅ No upper age limit for enrollment

-

✅ Multi-pet discount

Cons:

-

❌ Claims process can be lengthy

-

❌ Limited coverage for dental treatment

8. Sainsbury’s Bank Pet Insurance

Overview: Sainsbury’s Bank offers competitive policies with Nectar cardholder discounts.

Link: https://www.sainsburysbank.co.uk/pet-insurance

Plans & Pricing:

-

Time-Limited Plan: Covers up to £3,000 per condition for 12 months.

-

Lifetime Plan: Up to £10,000 vet fees annually.

Coverage Highlights:

-

Complementary treatments

-

Third-party liability

-

Lost pet cover

Pros:

-

✅ Nectar cardholders receive discounts

-

✅ 24/7 vet helpline

-

✅ Flexible policy options

Cons:

-

❌ Time-limited plans may not suit chronic conditions

-

❌ Premiums can increase with pet's age

9. John Lewis Finance Pet Insurance

Overview: John Lewis offers comprehensive policies with high vet fee limits and optional add-ons.

Link: https://www.johnlewisfinance.com/pet-insurance.html

Plans & Pricing:

-

Essential Plan: Covers up to £3,000 per condition.

-

Premier Plan: Up to £12,000 vet fees annually.

Coverage Highlights:

-

Dental treatment

-

Behavioral therapy

-

Overseas travel cover

Pros:

-

✅ High annual vet fee limits

-

✅ Optional add-ons for customization

-

✅ 24/7 vet helpline

Cons:

-

❌ Premiums can be higher than average

-

❌ Limited coverage for pre-existing conditions

10. Scratch & Patch

Overview: Scratch & Patch offers a range of policies with a focus on affordability and straightforward coverage.

Link: https://www.scratchandpatch.co.uk/

Plans & Pricing:

-

Basic Plan: Covers up to £2,000 per condition.

-

Premier Plan: Up to £8,000 vet fees annually.

Coverage Highlights:

-

Complementary treatments

-

Third-party liability

-

Lost pet cover

Pros:

-

✅ Affordable premiums

-

✅ Simple policy options

-

✅ Quick claims processing

Cons:

-

❌ Lower annual vet fee limits

-

❌ Limited coverage for dental treatment

📊 Comparison Table

| Provider | Basic Plan (Annual) | Premium Plan (Annual) | Key Features |

|---|---|---|---|

| Petplan | £3,000 | £12,000 | High claim approval, chronic cover |

| Agria | £6,000 | £20,000 | 24/7 vet consultations, behavioral |

| ManyPets | £3,000 | £15,000 | Pre-existing conditions, refunds |

| Waggel | £5,000 | £10,000 | Digital management, no age limit |

| Animal Friends | £1,000 | £18,000 | Charitable contributions, affordable |

| Tesco Bank | £3,000 | £10,000 | Clubcard discounts, 24/7 helpline |

| Direct Line | £4,000 | £8,000 | Optional add-ons, no age limit |

| Sainsbury’s Bank | £3,000 | £10,000 | Nectar discounts, flexible options |

| John Lewis Finance | £3,000 | £12,000 | High vet fee limits, add-ons |

| Scratch & Patch | £2,000 | £8,000 | Affordable, quick claims |

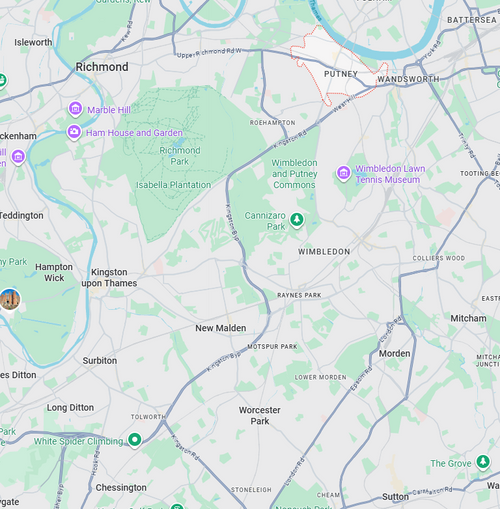

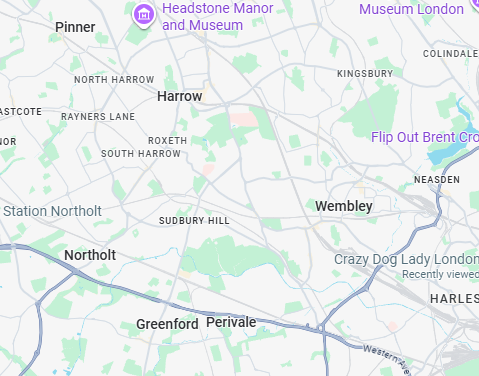

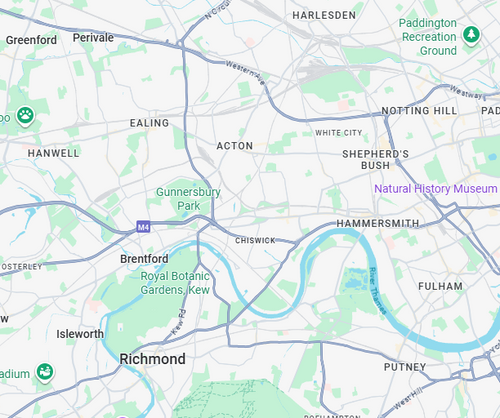

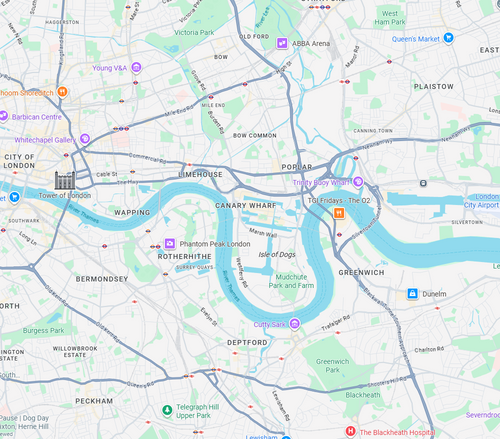

Note: Prices are indicative and may vary based on factors such as pet breed, age, and location.

Bonus Recommendation: The Kennel Club Pet Insurance

The Kennel Club Pet Insurance (underwritten by Agria) offers:

-

Lifetime Cover: Up to £7,500/year

-

Lifetime Plus: Up to £15,000/year

-

Lifetime Premium: Up to £25,000/year

💷 Example Cost: £92.30/month for Lifetime Premium (real user quote)

➕ Pros: Excellent lifetime options, 24/7 vet calls, third-party liability cover

❌ Cons: Premiums can be higher for older dogs

🌐 Learn More: kcinsurance.co.uk

📝 Last Bark

Choosing the right pet insurance policy is crucial for safeguarding your pet's health and your finances. Consider factors like coverage limits, exclusions, premiums, and additional benefits when selecting a provider. Always read the policy documents carefully and compare multiple options to find the best fit for your needs.

2 comments

Calmshops Support

Thanks for asking! The Kennel Club Pet Insurance wasn’t included in the original top 10 simply because most third-party review platforms at the time (like Which?, Trustpilot, and MoneySavingExpert) ranked providers like Petplan, Agria, and ManyPets higher in terms of value, customer service, and claim processing speed.

However, Kennel Club Insurance is backed by Agria and offers very strong lifetime cover options—so it’s absolutely a great choice, especially for pedigree dogs. That’s why we’ve now included it as an bonus mention and added it to the comparison table for fairness and clarity.

Jeni Sandercott

Why is The Kennel Club insurance not mentioned. I have been told it as good if not better than Pet Plan?